The Asset Building Coalition of Kitsap helps Kitsap County residents achieve financial security. We partner with other local organizations with a shared mission to provide financial education and resources that financially strengthen members of the community.

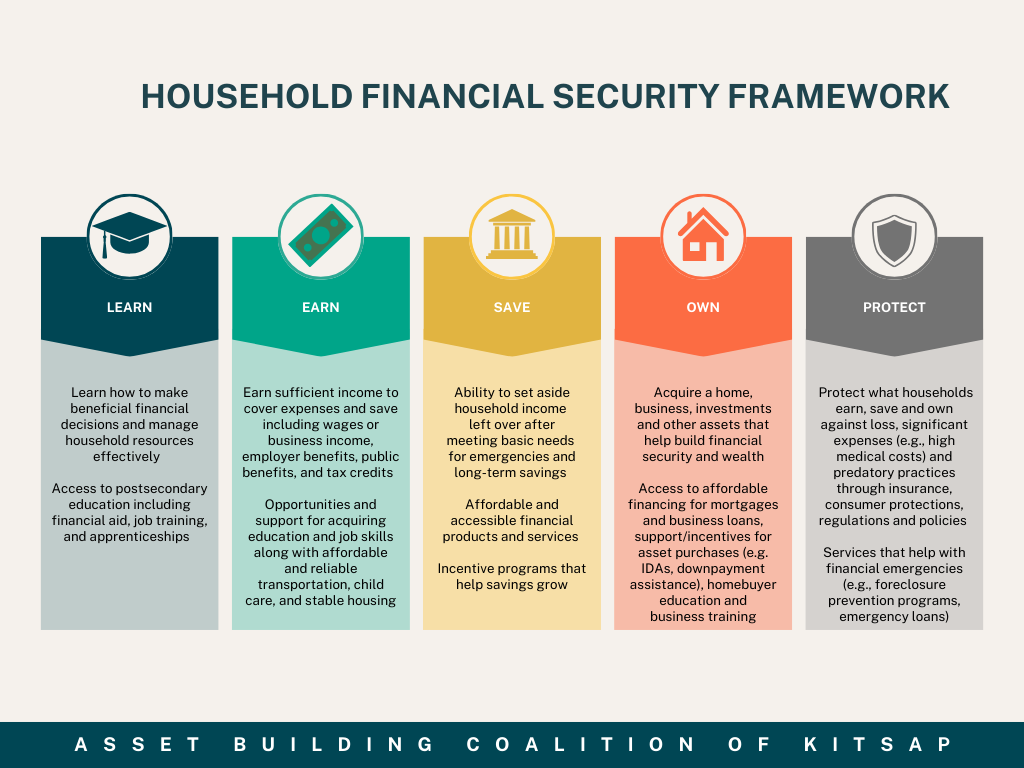

The Coalition is modeled after Prosperity Now‘s, Household Financial Security Framework adapted and summarized as shown below. We aim to help Kitsap County residents improve money management, increase earning potential through education, to be able to save more, grow assets, and then preserve those assets.

The Coalition is a collaborative partnership among businesses, nonprofits, government agencies, and other organizations from various backgrounds with a shared mission to improve the finances of individuals and families in Kitsap County. Members of the Coalition contribute to the mission in a variety of ways by leading financial education workshops, sharing resources, and helping to connect members of the community with programs and services that lead to financial security.

The Kitsap Asset Building Coalition is so grateful to have been awarded a Community Reinvestment Project grant from the Washington State Department of Commerce. In collaboration with our coalition partners, we have been able to provide direct funding to benefit historically marginalized members of the county with homeownership down payment assistance, business boost grants to help launch and grow small businesses and provide higher education scholarships to local students. The Community Reinvestment Project focuses on repairing wealth disparities in communities disproportionately harmed by the war on drugs.

This fact sheet summarizes what we’ve been up to recently:

Need help with learning more about financial aid for college? Check out this workshop below with Olympic College

See below for a great financial education opportunity Olympic College to learn more about consumer loans!

When this happens, it's usually because the owner only shared it with a small group of people, changed who can see it or it's been deleted.

When this happens, it's usually because the owner only shared it with a small group of people, changed who can see it or it's been deleted.

Another VITA tax site at St. Vincent de Paul Bremerton! See below for details

FREE VITA TAX FILING NOW AVAILABLE!

Kitsap Community Resources (KCR)

Location: 845 8th Street, Bremerton, WA

When: Every Wednesday, 3–7 PM

Starting: February 4, 2026

Kitsap Regional Library Slyvan Way

Location: 1301 Slyvan Way, Bremeton WA

When: Every Thursday, 2-6pm

Starting: February 5, 2026

Who qualifies? Household income must be under $69,000

📌 Appointments strongly encouraged

What to bring:

• Photo ID for you (and your spouse, if filing jointly)

• Social Security cards or ITIN letters for everyone on the return

• Birth dates for all

• A copy of your 2024 tax return

• If filing jointly, both spouses must be present

Please share to help spread the word!